Here's what most people get wrong about Web3.

They think it's about trading crypto, speculating on memecoins and NFTs, or hunting for airdrops.

That's not the opportunity. That's the noise.

The real opportunity is this:

Using the power of Web3 to completely reimagine how we do business

Let me explain…

Web3's killer app isn't what you think

The killer app of Web3 isn't a decentralized Twitter or a blockchain game.

It's the same killer app that made Web1 and Web2 succeed: helping businesses make money.

Consider the early internet. In the 1990s, it was hobbyists sharing text files and academics exchanging research. Interesting, sure. Revolutionary? Not yet.

The revolution came when businesses discovered they could sell things online. When people realized a website could generate revenue, everything changed. Suddenly there was capital flowing in. Infrastructure got built. Talent flooded in. The advertising model emerged – not because anyone loved ads, but because businesses needed to reach customers and were willing to pay for it. That spending funded the entire ecosystem. Content creators, service providers, infrastructure companies – everyone had a reason to build because there was money to be made.

Social media followed the same trajectory. YouTube in 2007? Grainy webcam videos and amateur clips. YouTube today? Professional studios, million-dollar productions, sophisticated media operations. What changed? Businesses figured out how to monetize attention. Creators became entrepreneurs. Brands built entire marketing strategies around social platforms. The "silly" thing became serious when profit potential emerged.

So what's Web3's version?

Web1 gave businesses storefronts.

Web2 gave them audiences.

Web3 gives them stakeholders.

Tokenization lets businesses turn customers into investors, users into evangelists, communities into distribution networks. It's a fundamentally new mechanism for aligning incentives and raising capital.

When businesses start using Web3 to get ahead of their competition – when they're not just experimenting but building core business models around it – that's when the flywheel spins. They'll fund infrastructure. They'll demand better tools. They'll push for mainstream adoption because their bottom line depends on it.

The question isn't whether Web3 has cool technology. It's whether it can help businesses win.

Everything else follows from there.

We've seen this movie before

Every internet era removes gatekeepers, expands reach, and slashes costs. The pattern is consistent.

Web1 revolutionized commerce

Before the internet, selling meant convincing stores to stock your product. Stores controlled access to customers. Getting shelf space was expensive and difficult.

Buyers shopped from maybe a few dozen local stores.

Today? Millions of online sellers. Anyone can launch a store and reach global customers instantly. Customer reviews, price comparisons, instant search – features impossible in the physical world.

The barrier collapsed. Sellers and buyers both won.

Web2 revolutionized media

Before social platforms, getting published meant pitching gatekeepers – newspapers, TV networks, radio stations. Exposure was expensive and rare.

Audiences chose from thousands of outlets globally.

Today? Hundreds of millions of creators. Anyone can publish and potentially reach millions. Likes, comments, reposts – direct audience feedback that traditional media never offered.

The barrier collapsed. Creators and audiences both won.

Web3 will revolutionize finance

Right now, raising capital means navigating gatekeepers – VCs, investment banks, stock exchanges. Going public is expensive, slow, and reserved for the few.

Investors can access roughly 50,000 publicly traded companies.

But there are 300 million companies worldwide. Nearly all of them are locked away from public investment.

Web3 can make them liquid and accessible – as easily as setting up an online store or social media account. Companies could go public on day one. Investors get infinite selection and global access. On-chain governance and transparent ownership become possible.

The barrier is collapsing. Companies and investors will both win.

What the future holds: the ultimate Web3 vision

Imagine companies owned by large passionate communities instead of just a few venture capital firms. Where decisions aren't made in quarterly board meetings – they happen in ongoing public forums where anyone can participate. When someone spots a better way to price the product or improve customer service, they propose it. If the community agrees and it works, that person earns equity.

This isn't crowdsourcing. It's co-ownership.

When challenges emerge, you have thousands of invested problem-solvers instead of a handful of executives. When leadership loses direction, the community course-corrects. When innovation stalls, someone in your community – maybe a user, maybe a developer halfway across the world – pushes it forward.

That's a competitive moat no traditional company can match.

New eras create new business models, not just new channels

Web1 didn't just move existing stores online. It unlocked entirely new possibilities: digital products created once and sold infinitely. Instant delivery. Zero shipping costs. Global virtual companies with distributed teams.

Web2 didn't just give brands exposure. It created the creator economy: individuals building audiences and launching products directly to customers. Multi-million and billion-dollar brands born from social media. No middlemen. Better products, unique experiences, direct customer involvement.

Web3 will do the same. It won't just let companies tokenize stock – it will enable entirely new structures. Community-powered businesses where everyone becomes a stakeholder: founders, investors, employees, contributors, customers. All aligned toward the same mission. All benefiting from the company's success.

Regular people will finally share in the upside of startups they help build.

Why this will actually happen

Shopping online is more fun than catalog ordering.

Social media is more engaging than broadcast TV.

Investing in companies you help build – where you contribute ideas, connect with like-minded people, and shape the direction – will be more engaging than passively buying index funds.

Everyone wins:

Companies grow faster with community support

Investors get better returns

Contributors earn fair rewards

Customers get better products

The economy gets more jobs, more tax revenue, more growth

If it sounds so good, why isn't it already here?

A few things stand in the way.

Right now, Web3 operates like a gold rush where everyone's trying to grab what they can before it collapses…

Founders disappear with investor money.

Early investors dump tokens on retail buyers.

Contributors extract maximum value and vanish.

Users run bot farms to exploit airdrops.

Nobody's building for the long term.

I explored this in detail in my previous articles:

The bottom line is that people treat Web3 as a zero-sum game – a place to get rich quick at someone else's expense – instead of a shared mission where everyone profits together.

Community-powered companies could fix this:

Aligned incentives.

Shared upside.

Long-term thinking baked into the structure.

But there's a bigger problem…

R-E-G-U-L-A-T-I-O-N

Want to issue company shares on a blockchain and trade them freely? Congratulations! You've just violated securities laws in multiple countries simultaneously.

That's why this hasn't happened yet.

But regulators aren't idiots. When the economic upside is massive and the framework is sound, laws adapt. It's just a matter of time.

Here's why I think it's inevitable:

1. Transparency eliminates information asymmetry

Regulators worry about insiders exploiting investors through hidden information. Fair concern.

Community-powered companies solve this at core by operating like open-source projects – financials and operations visible in real-time from day one. Not quarterly reports filed weeks late. Continuous, public transparency.

That's a higher standard than what public companies offer now.

2. Retail investors have an advantage here

Currently, regulators block regular people from investing in startups unless they're already wealthy.

The logic: protect the poor from losing money.

The result: the best deals go to the rich, making them richer.

Meanwhile, those same "protected" people can bet on sports or trade memecoins with leverage. Weird, huh?

But community-powered companies are actually better suited for retail than institutions.

BlackRock won't spend 20 hours researching a $10,000 investment in a local business. They need to deploy billions. The math doesn't work.

For a regular person? Spending a weekend analyzing a $10K investment in a coffee roaster or SaaS tool they understand – that's not just feasible, it's engaging. Plus, they can actually grasp the business model, unlike trying to analyze a conglomerate operating in 50 countries.

The upside matters more too. A company growing from $1M to $10M returns 10x. Good luck getting that from a $100B corporation. For large funds, 20% on $1B beats 2000% on $10K. For regular investors, it's the opposite.

And here's the real edge: retail investors can contribute beyond capital. Time, ideas, promotion, operational help – and now, for the first time, they can earn equity for it. Institutions don't want that. They can't scale it.

More investors means more contributors, more word of mouth, more collective intelligence. The crowd becomes the competitive advantage.

This might be the first investment category where small players have a structural advantage over Wall Street. Where retail isn't cannon fodder – they're the secret weapon.

3. Actually lower risk

Real companies backed by assets, revenue, and profits are fundamentally less risky than memecoins or governance tokens designed to have zero intrinsic value.

Directors have legal accountability. They're not anonymous accounts. Existing laws already make rug-pulling shareholders a crime. No new framework needed.

Companies can't go to zero as easily as tokens – there are assets underneath. They also can't go to the moon without substance backing it up. That bounds the range and makes fair value clearer.

Memecoins are designed to be pure speculation vehicles with zero promises. Infinitely riskier.

Plus, when you raise small amounts from many investors instead of large amounts from a few, one whale can't dump and crash the price. More liquidity. Less volatility. Easier exits.

If regulators actually care about protecting retail, this is the safer bet.

4. Real economic value

Companies produce goods and services. They create jobs. They pay corporate taxes, payroll taxes, VAT – not just capital gains.

They contribute to GDP growth. They solve real problems.

That's worth more to society than a market full of speculative tokens.

5. Innovation advantage

The first country to create a framework for community-powered companies will trigger an innovation boom.

Fierce competition driving better products at better prices. More investment options pulling capital into the economy. Long-term growth from new breakthroughs.

First-mover advantage on a structural shift.

The reality

Community-powered businesses benefit everyone: companies scale faster, investors get better returns, governments collect more taxes and see stronger growth.

It's a matter of when regulators catch up, not if.

So if this thesis is correct, the question becomes: how do you position yourself to capture it?

Here's my answer...

A platform for launching community-powered businesses

This is my secret plan.

We can't put company shares on blockchain and make them available to retail yet. But forming companies, raising capital, building communities – that's all perfectly legal.

Shares don't need to be on-chain from the start. When regulations evolve, we'll tokenize them. Right now, we work within existing frameworks.

The opportunity is too massive to sit on the sidelines.

That's why I'm building… EPICPAD.

A platform for launching, building, and scaling community-powered businesses.

Think of it as intersection of three models:

A launchpad – for discovering and funding promising ideas early

A startup studio – for turning concepts into real, profitable companies

An open-source community – for collaborating and governing businesses together

The four roles of EPICPAD

You can join the platform in one or multiple roles:

Role #1 – Leaders

Unlike traditional founders, leaders in EPICPAD are INTRApreneurs – they lead projects, bring ideas to life, and get full backing from the community. They don’t have to carry all the risk alone. They receive funding, resources, and collective support from the platform to execute bold ideas and build something that lasts.

Role #2 – Investors

Unlike other Web3 opportunities, EPICPAD protects investors from rug pulls. Funds are locked within the platform and released only as needed to cover project expenses. All financial data is transparent and available in real time – so you always know how your money is being used.

Role #3 – Contributors

Unlike employees, contributors work on their own terms. They can join any project they like, from anywhere in the world, and contribute as much (or as little) as they want. They’re free to negotiate payments, earn bonuses, and even secure a stake in projects they help bring to life.

Role #4 – Users

Unlike ordinary early adopters, EPICPAD users are active participants. They don’t just test products – they help shape them. By providing feedback, participating in governance, and supporting projects, users earn real rewards and ownership stakes.

This is how the vision begins. Not the end state, but the starting point.

Here's how the platform works

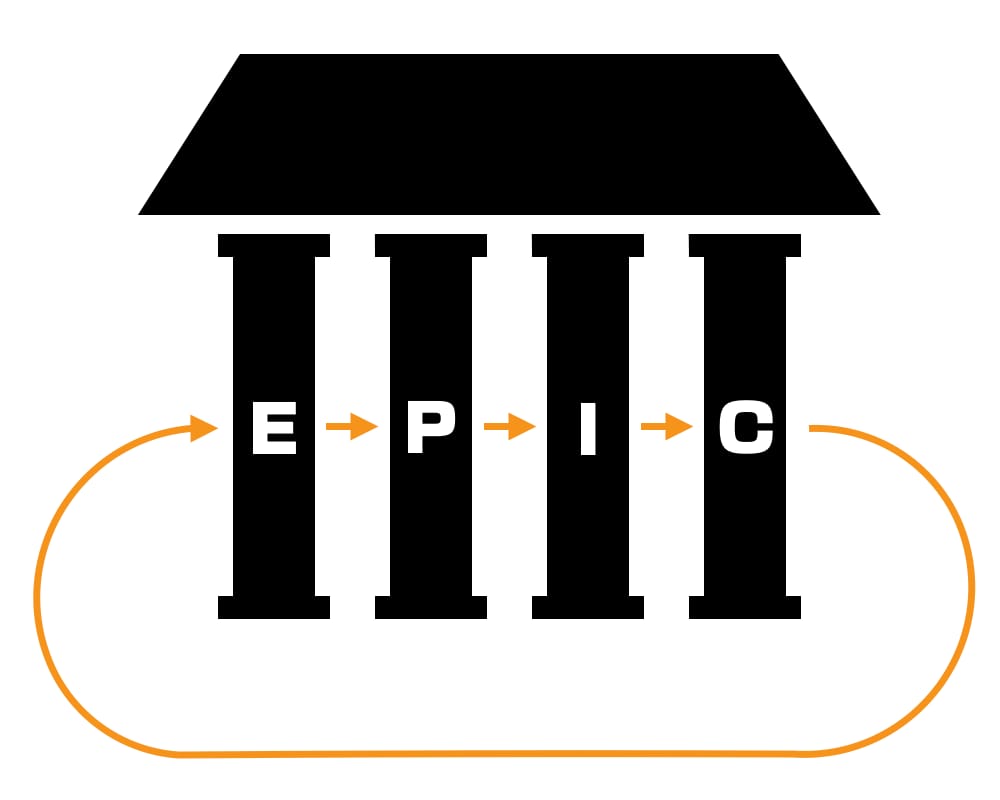

EPICPAD is built on 4 pillars – four interconnected sections that spell out EPIC, reflecting what kind of businesses we’re here to build, launch, and scale:

Pillar #1 – Education

To have top talent, we need to develop top talent. That's where we start.

This pillar is a living knowledge base – learning programs, frameworks, case studies, practical know-how. Available for free to everybody on the platform. All of it open to contributions and improvements from anyone, with rewards for valuable additions.

But here's what makes it powerful: roles can be fluid. A user today may want to become a contributor tomorrow. Contributors can step into leadership. Leaders can become investors. Investors can also explore other roles that interest them. The Education section guides the way.

The goal here is simple: ensure everyone becomes the best they can be at their role. That means creating an environment where all platform members constantly learn, evolve, and sharpen their skills – to tackle harder problems, achieve breakthroughs, and take on bigger projects.

Pillar #2 – Projects

This is where project ideas become vetted proposals and, eventually, funded businesses.

Anyone can submit an idea. The community then stress-tests it – asking questions, challenging assumptions, suggesting refinements. Through this collaborative process, rough concepts evolve into solid, vetted proposals.

When a proposal gains traction, people signal their intent through voting. Investors show willingness to fund it. Contributors volunteer their expertise. Users indicate whether they'd actually want to use the product. Leaders compete for the opportunity to run it.

The original idea proposer earns equity too, proportional to the effort put in.

Once a proposal has sufficient backing across all groups, it advances.

Pillar #3 – Investments

This is where commitment becomes capital.

Investors who expressed interest in the previous stage now put money behind the project – following all applicable laws and regulations based on their location, with proper legal documentation.

Early supporters who voted during the proposal stage get first access to allocation slots.

When funding targets are hit, the project goes into development. Funds are held in smart contracts and released incrementally as needed, with real-time spending reports and complete transparency. This structure eliminates rug pull risks while ensuring projects have the resources to execute.

As projects grow and need additional capital, future rounds happen here as well.

Pillar #4 – Communities

This is the engine that powers everything.

Every project gets a dedicated community hub where its entire journey is documented from day one. Who's working on what. Where time is going. Where money is being spent. Everything visible, fully accountable, all in real-time.

Community members can contribute ideas, provide support, discuss progress, flag concerns, submit proposals, and vote on decisions.

While the project leaders make final calls aligned with the company's mission and strategy, they're ultimately accountable to shareholders. If a leader fails to perform or acts against stakeholder interests, the community can vote them out and elect a replacement – similar to how democracies replace elected officials.

Anyone can put themselves forward for leadership at any time. Leaders earn equity through achieving milestones, not through time served. Naturally, if a leader delivers results and hits targets, there's no reason to replace them.

The flywheel effect

Here's where it gets interesting: every lesson learned from building real businesses flows back into the Education pillar. Better education creates stronger talent. Stronger talent builds better projects. Better projects attract larger investments. Larger investments grow bigger communities – which generate more insights to feed back into education.

A self-reinforcing cycle that accelerates over time.

The ecosystem advantage

Because every project exists within a unified platform, they create exponential value for each other:

Companies share lessons from wins and losses

Every business can tap into the platform's entire talent and capital network

Projects form partnerships and cross-promote

All stakeholder groups hold each other accountable

Reputation builds across the ecosystem and opens doors

The result: everyone benefits. Founders get support. Investors get returns. Contributors get rewarded. Users get better products. Society gets innovation and growth.

This is Web3 reimagined – positioned to transform any industry.

Why this matters

This isn't just about building better Web3 projects.

It's about reimagining how businesses work – how they're formed, funded, and run.

Think about the pattern:

Web1 made it essential to have a website.

Web2 made social media presence non-negotiable.

Web3 will make community ownership the new standard.

Remember when Bill Gates said in 1995: "If your business is not on the internet, your business will be out of business"? He was right.

At first, the internet was labeled a fad. Then people started saying "all companies are internet companies."

Then social media was just for kids. Then suddenly "all companies are media companies."

Bitcoin? A currency for criminals. Now sitting on corporate balance sheets and in government reserves.

The pattern repeats. What looks fringe today becomes infrastructure tomorrow.

Web3 might look like a casino now. But soon we may see a future where companies become "crypto companies" – not because they accept crypto payments or build on blockchains, but because they leverage community ownership, transparent governance, and aligned incentives.

The same way every business eventually needed a website, then a social media presence, they'll eventually need to be tokenized and community-powered.

Because otherwise, in the words of Mr. Gates – their “business will be out of business”.

This model will eventually spread to all industries.

And early movers will capture disproportionate value – just like e-commerce pioneers in the 2000s or social media creators in the 2010s. They built wealth and influence before the gold rush.

The question isn't whether this future arrives. It's whether you position yourself before everyone else does.

If you're ready, consider this your invitation to join EPICPAD.

How to join

Joining right now is application-only.

That's intentional. At this foundation stage, the goal isn't to attract as many people as possible. It's to find the RIGHT people – a core community who will shape the platform, establish the culture, build the first projects, and set the standards for everything that follows.

I need people who are active, supportive, and ready to contribute. And as the platform grows, they'll benefit the most.

Apply if you want to:

Launch and lead innovative projects

Invest in early-stage opportunities

Contribute valuable skills

Help build and shape the future of business

Fair warning: I'm not looking for lurkers or speculators. I'm looking for builders, contributors, and long-term believers who want to create something genuinely valuable.

If that's you, fill out this form to be among the founding members.

The earlier you join, the more influence you'll have – and the more you'll benefit as EPICPAD develops.

Let's connect

I'd love to hear what you think about all this.

If you’d like a deeper, behind-the-scenes look at EPICPAD’s journey, subscribe to my newsletter. That’s where I’ll share the platform’s progress, lessons learned, and broader insights on the topic of Web3.

Thanks for sticking with me through this whole thing. I know it was long, but I hope it got you thinking.